If you are considering applying for one of the Discover credit cards, it is likely that you are looking for benefits aligned with the needs of your current moment in life.

Maybe what you are looking for is financial freedom, cashback, practicality in everyday life or even help to raise your credit score. Regardless of the reason, discover credit cards are good options.

Discover has been in the market since 1985 and has been investing in offering good conditions to its customers. However, with so many options, it is difficult to know which one is best for each person.

With that in mind, we studied each of the best Discover credit cards. To explain each alternative to you, without fluff. That way, you’ll know exactly what each option has to offer. That way, you will find the best option, considering what you need now.

What is different about Discover from the others?

The Discover brand is accepted in millions of establishments in the US and several other countries, thanks to international partnerships.

However, Discover’s big difference is in the business model. They operate as issuer and flag at the same time. That is, no intermediaries. This makes customer service more agile.

In fact, they prioritize humanized care, available 24 hours a day.

Detailed analysis of Discover credit cards

1. Discover it® Cash Back (Discover credit cards)

Discover it® Cash Back is a great alternative for those who want to earn cash back. This is because cashback is the highlight of the card, including being considered one of the main credit card with cash back rewards, In it you will receive:

- 5% revolving cashback: Each quarter, you can activate a category (such as supermarkets, gas stations, restaurants) and earn 5% back on up to $1,500 in purchases;

- 1% fixed cashback on all other purchases;

- At the end of the first year, Discover doubles everything you’ve earned in cashback. Literally. If it accumulated US$ 200.00 it becomes US$ 400.00.

Rates are also important and should be considered. In this card, the main ones are:

- Introductory APR (purchases and balance transfers): 0% for 15 months

- After the initial period: APR variable from 18.24% to 27.24%

- Balance transfer fee: 3% initial (until November 10, 2025), then the fee can reach 5%

- Annual Fee: US$ 0.00

- Minimum interest: $0.50

- Fraud liability: $0.00

We recommend this card for those who spend regularly in everyday categories and want to have a return (cashback) without paying an annual fee.

2. Discover it® Student Cash Back

Are you in college and want to build credit? This card is one of the most suitable.

At first, you will have the cashback of the previous card (5% on a cashback of the category you choose) and 1% fixed on other purchases you make. In addition, you will have the following benefits:

- No annual fee;

- Access to the app with free FICO® Score.

Pay attention to the fees! See below which are the main ones:

- Introductory APR (purchases): 0% for 6 months

- After the initial period: Variable APR from 17.24% to 26.24%

- Fraud liability: $0

- Minimum interest: $0.50

And the most interesting thing about this card is that even though it is a card for students, it has benefits that help you in your daily life. Thus, students can have access to a good credit card, even without having a good score.

3. Discover it® Secured

If your credit history is negative or very low (less than 500 points), this card is the best option.

To be approved for it, you will have to make a deposit of at least US$ 200.00. Remembering that the larger the deposit, the higher your limit will be.

After all, why is this card a good alternative? Let’s look at its benefits:

- You’ll earn 2% cashback at restaurants and stations (up to $1,000 per quarter), and 1% on everything else;

- Credit review: after 7 months of using this card, Discover will reassess your limit. From there, you can get a credit limit, without needing a deposit.

So, like the other cards, here there are also fees that you should be aware of, the main ones being:

- Purchase APR: 27.24% Default Variable;

- Balance transfer APR: 10.99% for 6 months, then purchase APR applies;

- Cash Advance APR: 29.24% variable;

- Minimum interest rate: $0.50;

- Cash advance fee: $10 or 5% of the amount (whichever is greater);

- Balance transfer fee: 3% upfront; 5% for future transfers.

- Initial security deposit: from $200 (refundable)

Who is this card suitable for? Especially for negatives, as card approval is easy. Unlike other options on the market, where because it is negative, it is almost impossible to approve the card.

4. Discover it® Miles (Discover credit cards)

First of all, Discover it® Miles is one of the best cards for travel. As you can imagine, this card is approved for those who have a good limit, unlike the previous alternative.

At first, you will earn 1.5 miles per dollar spent, regardless of the purchase you make. In fact, in the first year, all miles earned are automatically doubled.

You can use the miles for various purposes, for example, tickets, accommodation, or even to pay the open bill.

Furthermore, you will not need to pay an annual fee on this card. It will still have 24/7 service, that is, every day, at any time. Remembering that at Discover it is not served by AIs, but by real humans

The main fees charged on this card are:

- Introductory APR (purchases and balance transfers): 0% for 15 months

- After the initial period: APR variable from 18.24% to 27.24%

- Cash advance fee: higher between $10 or 5%

- Balance transfer fee: 3% upfront; 5% for future transfers

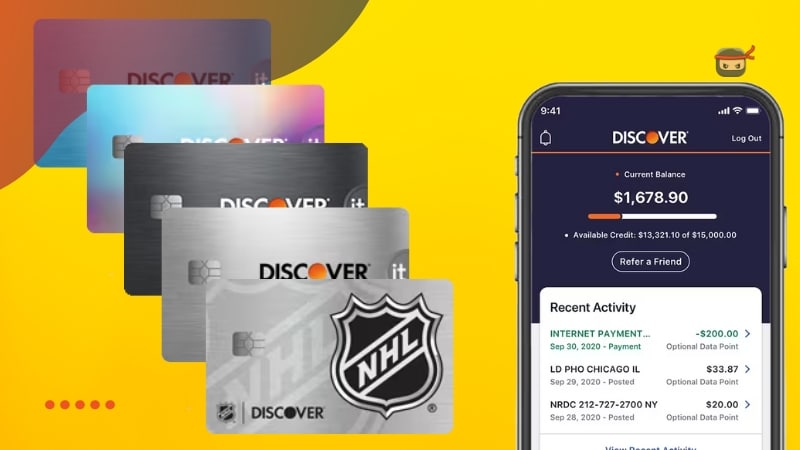

5. Discover it® NHL® Card

This is the card for you who are a fanatic of one of the NHL teams. That’s because you can choose the design of your card according to the team you support.

However, it is not just a card.

Not only is it a good-looking card, it will also have all the benefits of Discover it® Cash Back, including:

- 5% cashback by categories.

- 1% on other purchases.

- Cashback Match in the first year.

- No annual fee.

Its rates are:

- Introductory APR (purchases and transfers): 0% for 15 months

- After: Variable APR from 18.24% to 27.24%

- Balance transfer fee: 3% upfront by November 10, 2025; then up to 5%

- Annual Fee: None

- Minimum interest: $0.50

Is Discover app good?

On all credit cards, you’ll have access to the Discover app, where you can:

- Track your FICO® score, without having to pay anything;

- You can set usage alerts, for example, limit yourself to spending $200.00 per month;

- Talk to Discover support.

It will still have all the standard features of banking apps. For example, track expenses, receive and transfer money, see how much limit you have, among others.

Os Discover credit cards valem a pena?

The answer to this question depends on each one. Undoubtedly, it pays off if your focus is on having a credit card with no annual fee, with cashback, the opportunity to earn miles and even options for those who are negative.

Remembering that no card solves your life alone. It is a tool. Therefore, it can help or hinder, depending on how you use it.

Now, just go to the official Discover website and request the card that best meets your current needs.

Other cards worth checking:

See other cards with similar benefits to what you’re viewing.