Unlock a world of financial possibilities with our Discovery Bank Platinum Card review. Discover perks and features tailored to enhance your banking experience.

Discover a new standard in premium banking with the Discovery Bank Platinum Card. In this comprehensive review, we delve into the distinctive features, potential advantages, and considerations associated with this prestigious financial offering. Positioned as a symbol of elevated banking, the Discovery Bank Platinum Card caters to individuals who seek not only financial services but also a comprehensive approach to their banking needs. Join us as we explore the myriad benefits that come with this card, designed to enhance and simplify your financial journey.

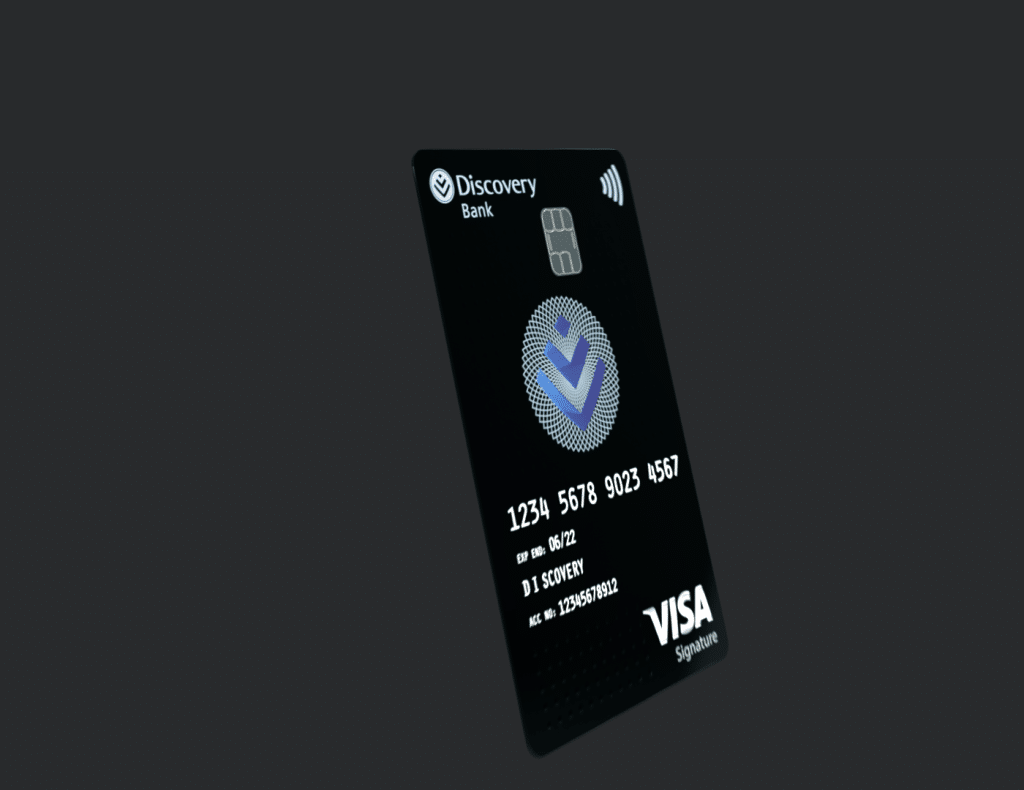

Unveiling the Discovery Bank Platinum Card

Redefining Premium Banking: The Discovery Bank Platinum Card goes beyond the conventional credit card, offering a holistic banking experience. As a premium offering from Discovery Bank, this card caters to those who value personalized service, exclusive benefits, and a seamless integration of banking and lifestyle solutions.

Key Features of the Discovery Bank Platinum Card

Dynamic Interest Rates: One of the standout features of the Discovery Bank Platinum Card is its dynamic interest rates. Unlike traditional banking models, this card offers interest rates that adjust based on your financial behavior. This unique approach encourages responsible financial management and can result in lower interest costs.

Cashback Rewards Program: The Cashback Rewards Program is a highlight of the Discovery Bank Platinum Card. Cardholders earn cashback on their card swipes, with the potential to boost their rewards based on various healthy financial behaviors. This program provides tangible benefits for everyday spending.

DISCOVERY BANK PLATINUM

DYNAMIC INTEREST RATESUP TO 75% BACK

Break free from the conventional and enjoy the best in life

Comprehensive Banking Solutions: Beyond a credit card, the Discovery Bank Platinum Card integrates a suite of banking solutions. This includes savings and investment options, creating a unified platform for managing your financial portfolio seamlessly.

Global Travel Benefits: For those with a global lifestyle, the Discovery Bank Platinum Card offers a range of travel benefits. From travel insurance to competitive forex rates, this card is designed to enhance your travel experience.

Priority Banking Services: Discover personalized service with priority banking features. The Discovery Bank Platinum Card provides cardholders with access to dedicated relationship managers and priority call centers, ensuring prompt and exclusive assistance.

Exclusive Lifestyle Rewards: Cardholders can enjoy exclusive lifestyle rewards that go beyond traditional banking benefits. These may include discounts on entertainment, wellness programs, and other lifestyle perks, enriching the overall value of the card.

Comprehensive Insurance Cover: Discovery Bank Platinum Cardholders benefit from comprehensive insurance cover, including life insurance and disability cover. This feature provides financial security, ensuring peace of mind for cardholders and their families.

Advantages and Benefits

Dynamic Interest Rates: The dynamic interest rates of the Discovery Bank Platinum Card offer a unique advantage. Cardholders benefit from rates that adjust based on their financial behavior, encouraging responsible financial management and potentially resulting in lower interest costs.

Cashback Rewards Program: The Cashback Rewards Program adds tangible value to everyday spending. Cardholders earn cashback on card swipes and have the opportunity to boost their rewards through healthy financial behaviors, providing a practical and rewarding incentive.

Comprehensive Banking Solutions: The integration of savings and investment options into the Discovery Bank Platinum Card platform offers a holistic approach to financial management. Cardholders can efficiently manage their entire financial portfolio in one place, streamlining their banking experience.

Global Travel Benefits: For frequent travelers, the Discovery Bank Platinum Card offers a range of global travel benefits. From travel insurance to competitive forex rates, these features contribute to a seamless and enjoyable travel experience.

Priority Banking Services: Access to priority banking services ensures that Discovery Bank Platinum Cardholders receive personalized and expedited service. The presence of a dedicated relationship manager and priority call centers enhances the overall banking experience.

Exclusive Lifestyle Rewards: Exclusive lifestyle rewards extend beyond financial benefits. Discovery Bank Platinum Cardholders can enjoy discounts on gym memberships, entertainment experiences, and other lifestyle perks, enhancing the overall value of the card.

Comprehensive Insurance Cover: The comprehensive insurance cover provides a layer of financial security for Discovery Bank Platinum Cardholders. With life insurance, disability cover, and other protections, cardholders and their families can face unexpected events with confidence.

Considerations and Potential Drawbacks

Annual Fee: The Discovery Bank Platinum Card comes with an annual fee, and potential cardholders should carefully assess this fee against the benefits provided. The value of the card’s features and services should justify the annual cost.

Eligibility Criteria: Securing the Discovery Bank Platinum Card is subject to eligibility criteria. This may include a minimum income requirement and other factors. Individuals interested in the card should ensure they meet the specified criteria before applying.

Integration Learning Curve: While the integration of banking solutions is a notable feature, some cardholders may experience a learning curve as they navigate the platform’s various functionalities. Discovery Bank should provide adequate support and resources to assist users in maximizing this feature.

Limited Global Acceptance: While the Discovery Bank Platinum Card offers competitive forex rates and global travel benefits, there may be instances of limited acceptance at certain merchants or locations. Cardholders should be aware of this when relying on the card for international transactions.

How to Apply for the Discovery Bank Platinum Card

You will be redirected to the bank’s official website

Application Process: Applying for the Discovery Bank Platinum Card involves an online application process. Potential cardholders can visit the official Discovery Bank website, navigate to the Platinum Card section, and follow the steps outlined in the online application form.

Eligibility Check: Discovery Bank will conduct an eligibility check based on the information provided in the application. This includes assessing the applicant’s income, credit history, and other relevant factors to determine if they meet the criteria for the Discovery Bank Platinum Card.

Document Submission: As part of the application process, individuals may need to submit necessary documentation, including proof of identity, proof of income, and other details specified by Discovery Bank. Ensuring the accurate submission of these documents supports a smooth application process.

Card Issuance and Activation: Upon successful approval, eligible applicants will receive their Discovery Bank Platinum Card. The card will need to be activated as per the instructions provided by Discovery Bank before it can be used for transactions.

Conclusion: Discovery Bank Platinum Card Review

The Discovery Bank Platinum Card represents a paradigm shift in premium banking, offering a comprehensive and integrated approach to financial management. Potential cardholders should carefully weigh the advantages against potential drawbacks, ensuring that the Discovery Bank Platinum Card aligns with their financial goals and lifestyle.

This review serves as a comprehensive guide for those contemplating the Discovery Bank Platinum Card, providing insights into its key features, advantages, and considerations. Through informed decision-making and strategic usage, cardholders can elevate their financial experience with the Discovery Bank Platinum Card.