Applying for a NEO Financial Mastercard can be an excellent choice for anyone looking to benefit from innovative financial products with competitive rewards and interest rates. See how to apply for a NEO Financial Mastercard.

This guide will walk you through the entire application process, providing tips and important details to ensure you have the smoothest experience possible.

How to Apply for a NEO Financial Mastercard?

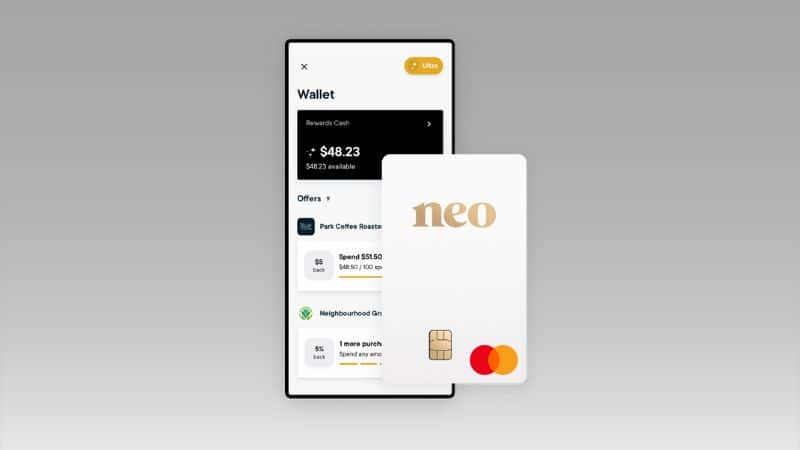

NEO Financial is known for its modern approach to banking and credit services. The NEO Financial Mastercard offers a range of benefits, including cashback on purchases, no annual fees, and a user-friendly mobile app.

Whether you’re a seasoned credit card user or applying for your first card, understanding the application process is crucial.

Step-by-Step Application Process – How to Apply for a NEO Financial Mastercard

Step 1: Check Eligibility

Before applying, it’s important to check if you meet the eligibility criteria. Typically, you need to:

- Be at least the age of majority in your province or territory

- Have a valid Canadian address

- Possess a good credit score

Step 2: Gather Necessary Documents

To ensure a seamless application process, gather the following documents beforehand:

- Government-issued ID (e.g., passport or driver’s license)

- Proof of address (e.g., utility bill or bank statement)

- Social Insurance Number (SIN) for credit verification

Step 3: Visit the Official Website – How to Apply for a NEO Financial Mastercard

Go to NEO Financial’s official website to start your application. Look for the credit card section and select the NEO Financial Mastercard.

Step 4: Fill Out the Application Form

Complete the online application form with accurate information. You’ll need to provide:

- Personal details (name, date of birth, email, etc.)

- Financial information (annual income, employment status)

- Contact details (address, phone number)

Step 5: Review and Submit – How to Apply for a NEO Financial Mastercard

Double-check your application for any errors. Reading through the terms and conditions is also essential to understand your obligations and benefits. Once satisfied, submit your application.

Step 6: Await Approval

After submission, your application will undergo a credit check. Approval times can vary, but typically you will receive a response within a few business days. If additional information is required, NEO Financial will contact you directly.

What to Expect After Approval

Upon approval, you will receive your NEO Financial Mastercard within 5-10 business days. The card will come with activation instructions, which you can typically complete through the NEO mobile app or by calling customer service.

Table: Overview of the Application Process

| Step | Action | Expected Timeframe |

|---|---|---|

| 1. Check Eligibility | Verify age, residence, and credit criteria | Immediate |

| 2. Gather Documents | Collect ID, proof of address, and SIN | Varies |

| 3. Online Application | Visit website, locate the credit card section | Immediate |

| 4. Fill Out Form | Enter personal and financial details accurately | 10-20 minutes |

| 5. Review & Submit | Double-check details and agree to terms | Immediate |

| 6. Await Approval | Application undergoes credit check, wait for response | A few business days |

Frequently Asked Questions about the NEO Financial Mastercard

Here are ten frequently asked questions and their answers to help you understand the NEO Financial Mastercard better.

1. What are the main benefits of the NEO Financial Mastercard?

The NEO Financial Mastercard offers several attractive benefits, including cashback on all purchases, no annual fees, and low-interest rates. Additionally, cardholders enjoy exclusive offers and discounts at partner merchants.

2. How can I apply for a NEO Financial Mastercard?

You can apply for the NEO Financial Mastercard by visiting the NEO Financial website, navigating to the credit card section, and filling out the online application form with your personal and financial information.

3. What is the eligibility criteria for applying for this card?

To be eligible for the NEO Financial Mastercard, you must be at least the age of majority in your province or territory, have a valid Canadian address, and possess a good credit score.

4. Are there any fees associated with the NEO Financial Mastercard?

The NEO Financial Mastercard does not have an annual fee. However, other standard fees such as interest on unpaid balances and charges for foreign transactions may apply.

5. How long does it take to receive the card after approval?

Once your application is approved, the NEO Financial Mastercard typically arrives within 5-10 business days, depending on your location.

6. Can I use the NEO Financial Mastercard internationally?

Yes, the NEO Financial Mastercard can be used internationally. It is accepted anywhere that Mastercard is accepted. Keep in mind that foreign transaction fees may apply.

7. How do I activate my NEO Financial Mastercard?

You can activate your NEO Financial Mastercard through the NEO mobile app or by calling NEO Financial’s customer service. Instructions will be provided with your card upon arrival.

8. What should I do if my card is lost or stolen?

If your NEO Financial Mastercard is lost or stolen, report it immediately to NEO Financial’s customer service to prevent fraudulent use and to issue a replacement card.

9. How does the cashback program work?

The cashback program with the NEO Financial Mastercard automatically applies cashback on all eligible purchases, with no limits on the amount you can earn. The specific cashback rates may vary based on the promotions and partnerships available at the time of your purchase.

10. Is there a mobile app available for managing my NEO Financial Mastercard?

Yes, NEO Financial offers a user-friendly mobile app that allows you to manage your account, track spending, view your cashback earnings, and more, directly from your smartphone.

These FAQs aim to cover the essential aspects of owning and using a NEO Financial Mastercard, making your financial decisions more straightforward and informed.

Is the NEO Financial Mastercard Good?

When considering a new credit card, it’s essential to weigh the features and benefits against your personal financial needs and spending habits. The NEO Financial Mastercard has several key attributes that make it a compelling choice for many Canadian consumers.

Key Features and Benefits

1. Cashback Rewards: One of the most attractive features of the NEO Financial Mastercard is its cashback program. Unlike many other cards, NEO offers high cashback rates on everyday purchases without any caps. This means the more you use the card, the more you can earn back.

2. No Annual Fee: The absence of an annual fee is another significant advantage, making it easier to manage your finances without worrying about an extra yearly cost. This feature is particularly beneficial for those who prefer not to commit to a fee-based card.

3. User-Friendly Mobile App: NEO Financial provides a modern, intuitive app that allows cardholders to manage their accounts efficiently. Through the app, users can track spending, view transaction histories, and check their cashback earnings, all in real-time.

4. Flexible Security Features: The card includes contemporary security features, such as instant transaction notifications and the ability to lock the card from the app, which enhances safety and gives users peace of mind.

5. Wide Acceptance: As it is a Mastercard, it is accepted globally at countless merchants, making it an excellent option for both domestic use and international travel.

Considerations – How to Apply for a NEO Financial Mastercard

While the NEO Financial Mastercard offers numerous benefits, it’s important to consider a few factors:

- Credit Requirements: Like most credit cards, a good credit score is necessary for approval. This might be a limitation for those with lower or no credit history.

- Interest Rates: While the card offers competitive interest rates, they can still accumulate if balances are not paid in full. It’s crucial to manage balances wisely to avoid debt.

- Limited Physical Branch Support: NEO Financial operates primarily online, which might be a drawback for those who prefer in-person banking services.

Conclusion – How to Apply for a NEO Financial Mastercard

Overall, the NEO Financial Mastercard is an excellent choice for those who value simplicity, rewards, and modern financial management tools. Its features cater well to a tech-savvy, financially conscious demographic.

Whether it aligns with your needs depends on your financial situation and credit card usage habits. If these features resonate with your lifestyle, then the NEO Financial Mastercard might just be a great fit.

Ready to Apply? Start Your NEO Financial Mastercard Journey Today

Embarking on your journey with the NEO Financial Mastercard is just a few clicks away. By choosing this card, you’re not just applying for another piece of plastic, but for a gateway to smarter spending, rewarding experiences, and financial flexibility.

Why Choose NEO Financial Mastercard?

The NEO Financial Mastercard stands out in the crowded field of credit options with its promise of no annual fees and a robust cashback program that rewards you every time you spend. Whether you’re shopping online, dining out, or making everyday purchases, the NEO Financial Mastercard ensures that every transaction is more rewarding.

How to Get Started

Applying for your NEO Financial Mastercard is a simple, streamlined process:

- Visit the NEO Financial Website: Start by navigating to the official NEO Financial website. It’s user-friendly and secure, ensuring your personal information is protected every step of the way.

- Fill Out the Application: The application form is straightforward. You’ll need to input your personal details, financial information, and employment status. Make sure you have your documentation ready to speed up the process.

- Submit and Await Approval: Once your application is complete, submit it and wait for approval. This typically takes just a few business days, and you’ll be notified via email or directly through the app.

Act Now

Don’t miss out on the opportunity to enhance your financial life. Apply for the NEO Financial Mastercard today and start enjoying the benefits immediately. Whether you’re consolidating debt, managing daily expenses, or just looking for a reliable and rewarding credit card, the NEO Financial Mastercard could be the perfect fit for you.

Ready to take the next step? Click the button below to start your registration.

You will go to the official card website!

More options you might like:

See other cards with similar benefits to what you’re viewing.