What is the Ideal Credit Utilization Ratio. Learn how to manage and improve your credit utilization for financial well-being.

Navigating the intricacies of credit involves understanding various factors, and one critical aspect is the credit utilization ratio. This comprehensive guide aims to unravel the mysteries surrounding the ideal credit utilization ratio, shedding light on its importance, calculation, and the impact it has on individual credit scores. Whether you’re a seasoned credit user or just starting your financial journey, this guide covers everything you need to know about maintaining an optimal credit utilization ratio.

Understanding Credit Utilization Ratio: An Overview, Before delving into the specifics of the ideal credit utilization ratio, it’s essential to establish a foundational understanding. This section provides an overview of credit utilization ratio, its definition, and why it matters in the world of credit.

Credit utilization ratio, often referred to as the credit card utilization rate, is a key metric that measures the percentage of available credit being used. This ratio holds significant weight in determining an individual’s creditworthiness, making it a crucial aspect of responsible credit management.

Calculation of Credit Utilization Ratio

Formula for Credit Utilization Ratio: Explore the formula used to calculate credit utilization ratio. This section breaks down the steps involved in determining this ratio and provides clarity on how individual credit card balances contribute to the overall calculation.

Example Calculation: Delve into an illustrative example to better understand how credit utilization ratio is calculated in a real-world scenario. This section walks through the process using hypothetical numbers to demonstrate the application of the formula.

The Significance of the Ideal Credit Utilization Ratio

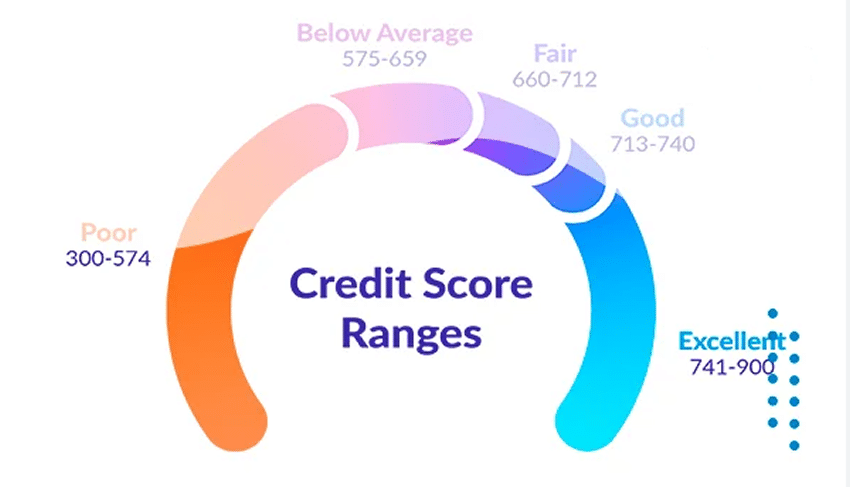

Impact on Credit Scores: Understand how credit utilization ratio directly affects credit scores. This section explores the correlation between high or low utilization ratios and their impact on FICO scores, shedding light on the nuances of credit score calculations.

Creditworthiness and Lender Perception: Delve into the broader implications of credit utilization on creditworthiness. Explore how lenders perceive different utilization ratios and how it influences their decisions when individuals apply for credit.

Determining the Ideal Credit Utilization Ratio

General Guidelines: Explore general guidelines and industry recommendations for maintaining an ideal credit utilization ratio. Understand the benchmarks that financial experts often suggest for optimal credit management.

Consideration of Individual Circumstances: Understand the importance of considering individual financial circumstances when determining the ideal credit utilization ratio. Factors such as income, expenses, and financial goals play a role in defining what may be ideal for each person.

Strategies for Managing Credit Utilization

Paying Down Balances: Explore effective strategies for reducing credit card balances and improving credit utilization. This section provides actionable tips for individuals looking to lower their utilization ratio.

Increasing Credit Limits: Delve into the option of increasing credit limits as a strategy for managing credit utilization. Understand the potential benefits and considerations associated with requesting and receiving higher credit limits.

Strategic Use of Multiple Credit Cards: Explore how the strategic use of multiple credit cards can impact credit utilization. This section provides insights into managing multiple cards responsibly to achieve a favorable utilization ratio.

Monitoring and Maintaining a Healthy Credit Utilization Ratio

Regular Monitoring Practices: Learn about the importance of regular monitoring of credit utilization. Understand how consistent monitoring allows individuals to identify changes, address issues promptly, and maintain healthy credit habits.

Automated Tools and Alerts: Delve into the role of automated tools and alerts in managing credit utilization. Explore how technology can assist individuals in staying informed about their credit card balances and potential fluctuations in utilization.

Common Misconceptions About Credit Utilization

Closing Unused Credit Cards: Address the misconception surrounding the idea of closing unused credit cards to improve credit utilization. This section provides clarity on the potential impact of such actions on credit scores.

Immediate Impact of Utilization Changes: Explore the common misconception about the immediate impact of changes in credit utilization. Understand the timeline for credit score adjustments after modifications to utilization ratios.

Conclusion: What is the Ideal Credit Utilization Ratio

As we conclude this comprehensive guide to the ideal credit utilization ratio, it’s evident that this metric holds significant influence over individual credit scores and financial well-being. By understanding how credit utilization is calculated, recognizing the ideal benchmarks, and adopting effective strategies for management, individuals can navigate the world of credit more confidently.

Remember, maintaining a healthy credit utilization ratio is not just about meeting industry standards but aligning credit practices with individual financial goals. Regular monitoring, strategic credit card usage, and proactive steps toward improvement contribute to a positive credit profile and open doors to better financial opportunities.