Are you in need of money? Bad credit loans with no upfront fees can be a quick solution to be able to reorganize your financial life.

We have selected the 5 best bad credit loans with no upfront fees alternatives, managing to understand the amount you can use, interest rates and the required credit score.

You will also know all the advantages and disadvantages of each of the options. That way, in 5 minutes you will understand literally everything about each of the best bad credit loans with no upfront fees available.

1. Upstart (Bad Credit Loans with no Upfront Fees)

Upstart is a great option for those looking for bad credit loans with no upfront fees, Let’s check out the main details of credit. We will start by looking at the amounts, fees and payment term:

- Competitive APR: Rates range from 6.70% to 35.99%;

- Available amount: gets $1,000 to $50,000;

- Flexible terms: The loan terms are 36 or 60 months.

- Variable origination fee: From 0.00% to 12.00%, applied at the time of contracting;

- Minimum credit score: must have at least 300 score points.

From this, we can extract the following advantages from this loan:

- Fast approval: the required score is low, which facilitates your approval for the loan;

- Quick release: the amount is made available in a short time;

If you are determined to apply for credit, know that you must meet the following requirements:

- Age: Minimum of 18 years old.

- Employment or income: One must have a regular income or a job offer that starts within six months.

- Credit factors: Debt-to-income ratio below 50% (or 45% in some states), no bankruptcies in the last year, and no more than six credit inquiries in the last six months.

In this way, Upstart stands out for being affordable, especially for those with low credit scores. However, it is not the only option, keep reading.

2. Prosper

Prosper is another excellent option for you looking for bad credit loans with no upfront fees. Let’s see what the payment terms are:

- Competitive APR: Rates range from 8.99% to 35.99%;

- Available amount: Gets $2,000 to $50,000;

- Flexible terms: Loan terms range from 24 to 60 months;

- Variable origination fee: From 1.00% to 9.99%, applied at the time of contracting;

- Minimum credit score: Must have at least 560 score points.

From this, we can extract the following advantages from this loan:

- Affordable approval: One of the lowest credit score requirements on our list;

- Co-borrowing possibility: You can apply for a loan with someone else, increasing your chances of approval;

In this way, Prosper is a great affordable and flexible option, especially for those who need a co-borrower or are looking for support during difficult times.

3. Upgrade (Bad Credit Loans with no Upfront Fees)

Upgrade offers great loan terms, requiring only 560 credit score points. Keep reading and check out everything about this option:

- Competitive APR: range from 8.99% to 35.99%;

- Available amount: gets $2,000 to $50,000;

- Flexible terms: varies from 24 to 60 months;

- Variable origination rate: From 1.00% to 9.99%;

However, not everything is advantages, there are points of attention in this line of credit. You will first have to pay an additional fee of US$ 10.00 for delay, and US$ 10.00 in fees for failed payment attempts.

In addition, the loan is not released if the objective is to pay off debts related to college. Apart from this restriction, you can use the money for any purpose.

4. Best Egg

Best Egg is another alternative for those who want loans with low requirements. Let’s check out the main details of the credit. We will start by looking at the amounts, fees and payment terms:

- APR: range from 7.99% to 35.99%;

- Available amount: Gets $2,000 to $50,000;

- Flexible terms: from 36 to 84 months;

- Variable origination rate: From 0.99% to 9.99%;

- Minimum credit score: Must have at least 580 score points.

From this, we can highlight some advantages of this loan. One of Best Egg’s main differentials is the installment payment that reaches 84 months.

Furthermore, the required score is low, making it easier to pass. Another positive point is the value that can reach $50,000.

On the other hand, it is important to be aware of the fees, especially the origination fee, which can reach 9.99% In fact, if you opt for a secured loan, you may lose your assets if you default.

5. Happy Money

Happy Money is another alternative for those looking to pay off debts through a quick loan, with a low credit requirement. Let’s see everything relevant about this credit:

- Reduced APR: Rates range from 8.95% to 17.48%;

- Available amount: Gets $5,000 to $40,000;

- Flexible terms: varies from 24 to 60 months;

- Variable origination rate: From 1.50% to 5.50%;

- Minimum credit score: Must have at least 640 score points.

One of the main advantages of Happy Money is that it does not charge an application fee, an early payment penalty, or late fees, making payment more transparent and accessible.

Additionally, the eligibility requirements are clear, providing security to customers. On the other hand, there are some worrying points. Unlike other lenders, Happy Money does not allow you to apply for credit with a co-borrower.

In addition, the loans are exclusively for the payment of credit cards, limiting their use. In addition, the payment term is lengthy when purchased on average, being released within 6 business days. Based on the above, it is clear that this is one of the best personal loans for debt consolidation.

Conclusion

We seek to select the best bad credit loans with no upfront fees, covering all the relevant details about each of the credit options.

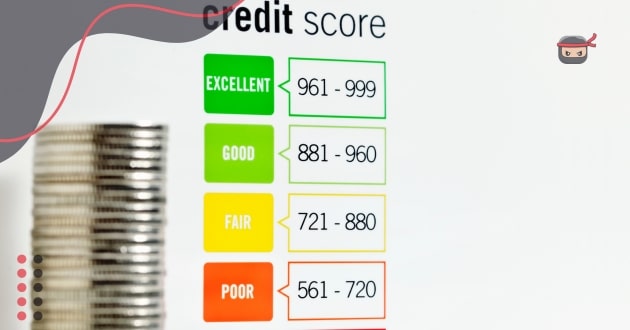

As you can see, there are options for those who have a higher score (from 500 to 700) to those who are going through difficulties and automatically the score is low (from 300 to 500).

Analyze each of the alternatives well, so that you can make your choice with peace of mind. That way, you can decide the best one for your case, taking into account mainly the fees and the amount you can get.