Applying for a credit card may seem complicated at first, but nowadays the process is easier and faster than ever, especially after knowing the step-by-step guide on how to apply for a credit card online.

Choosing the right card, knowing your credit score, and understanding the available offers are key steps to ensure the best possible approval.

We will help you understand how to apply for your credit card online safely, quickly and without compromising your score.

1. Find the right credit card

Applying for a credit card starts with the right choice, as not all cards are the same. Therefore, before submitting a request, you need to identify the card that meets your needs.

If the intention is to use the card for international travel, the ideal is to look for options that do not charge transaction fees abroad.

On the other hand, if ease of payment is prioritized, a card with a low interest rate may be the best choice. Now if you want to go shopping day to day, there are cards that offer rewards programs.

As there are several options on the market, after the step-by-step guide we will explain some of the best alternatives on the market.

2. Know your credit score before applying for the card

Before applying for the card, check your score. This score is used by banks to determine whether or not you will get the card, as well as your credit limit. The better your score, the more benefits you will have on the cards and you will still have access to more attractive rates.

We recommend that you use Experian to do this detailed check of your financial history.

Here’s the tip! Every time you try to apply for a card and it is denied, it suffers an impact on your score (usually reducing it). That’s why it’s important to know your score before starting any request.

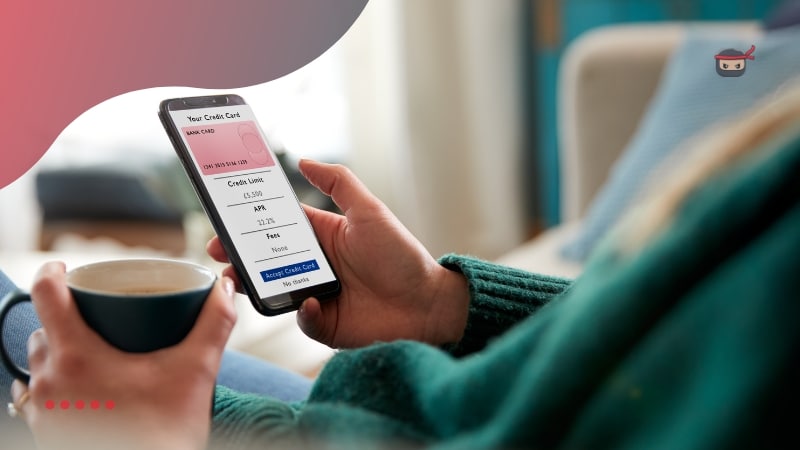

3. Make sure you understand credit card offers (How to Apply for a Credit Card Online)

Before accepting a credit card offer. Learn about details such as

- Credit limits;

- Annual Interest Rate (APR);

- Annuity charged.

These are the basis for understanding how much the credit card can cost you. The reason for this is that by knowing the amount available to spend and the rate that will be charged if you default, you run the risk of exceeding the allowed limit or getting into debt paying more interest than you imagined.

4. Check your eligibility

Another point is to check your eligibility. Each rejected application can hurt your credit score, making future approvals more difficult.

To avoid this, many financial institutions offer a pre-approval review. Thus, you already have an idea of the indicative limit and the chance of acceptance, without compromising your score unnecessarily.

5. Fill out the application

Applying for a credit card online is the easiest and fastest way to apply.

To ensure that your request is completed smoothly, it is important to already have all the information that will be required at hand. Typically, you’ll need to provide:

- Home address;

- Current income;

- Fixed expenses.

If you are planning to transfer debts from another card to the new one, you will also need to present the details of the previous card. Organizing this information in advance facilitates the process and increases the chances of approval.

Which credit card to apply for?

As we explained before, thinking about helping you choose your credit card, we will present you with some of the best alternatives on the market:

1. American Express Gold (How to Apply for a Credit Card Online)

American Express Gold is an option for those who want to accumulate points, especially when traveling.

One of its highlights is the initial offer of up to 90,000 Membership Rewards® points, awarded upon reaching $6,000 in spending in the first six months.

APR rates, on the other hand, usually fluctuate between 20.24% and 28.24%.

Another differential is the possibility of customizing the card, choosing between Gold or Pink colors, without changing the available privileges.

The card also offers $120 in Uber Cash per year, with a monthly credit of $10.

Above all, the card also offers a points program that works as follows:

- 4 points per dollar spent in restaurants and supermarkets;

- 3 points per dollar on airline tickets purchased directly from the companies or through the AmexTravel.com;

- 2 points per dollar in prepaid hotels;

- 1 point per dollar on other purchases.

With all these attributes, American Express Gold positions itself as one of the best credit cards right now. However, to obtain it, it is common to need a high credit limit. By the way, if you like rewards, know that there are other options for credit card rewards programs.

2. Upgrade Card Visa

The Visa Upgrade Card combines the flexibility of a traditional credit card with the predictability of a personal loan, making it an option for those looking for financial control and ease of payment.

The interest rate ranges between 14.99% and 29.99%, and there is no introductory APR for purchases. In addition, there is no annual fee.

One of the differentials of the Visa Upgrade Card is that it transforms its expenses into fixed installments, allowing the holder to know exactly how much they will need to pay each month.

In addition, contactless payment technology is already integrated, offering more convenience and security in transactions.

Plus, you can check your pre-qualification within minutes without impacting your credit score.

Another strong point of the Visa Upgrade Card is the protection against unauthorized transactions through Visa’s Zero Liability Policy, ensuring that if you suffer a scam, the bank and the card brand are responsible.

Citi Simplicity® Card

The Citi Simplicity® Card is an option for those who want to focus on paying off debt or making purchases without worrying about unexpected fees.

It stands out for its rates:

- 0% APR on purchases during the first 12 months;

- 0% APR on balance transfers for 21 months;

- Interest rate (APR) now varies between 18.24% and 28.99%.

For those who deal with balances on other cards, this advantage makes Citi Simplicity even more attractive, as it will have a long window to pay off debts without the pressure of interest accumulating quickly.

In addition to the financial advantages, the card offers security features such as Citi® Quick Lock. Thus, it can basically quickly block the card in case of loss or theft, offering greater protection to the user.

Conclusion

Applying for a credit card online is simple, as long as you follow the correct steps. From identifying the card that best suits your profile, knowing your credit score, understanding the available offers and confirming your eligibility, to filling out the application form carefully. Each step is important to increase your chances of approval and avoid future problems.

In addition, knowing options such as American Express Gold, the Visa Upgrade Card and the Citi Simplicity® Card will help you make a more conscious choice. However, don’t rule out other alternatives that have caught your attention.

Recommended for you:

See other cards with similar benefits to what you’re viewing.